What Is Base Rate Fallacy? | Definition & Examples

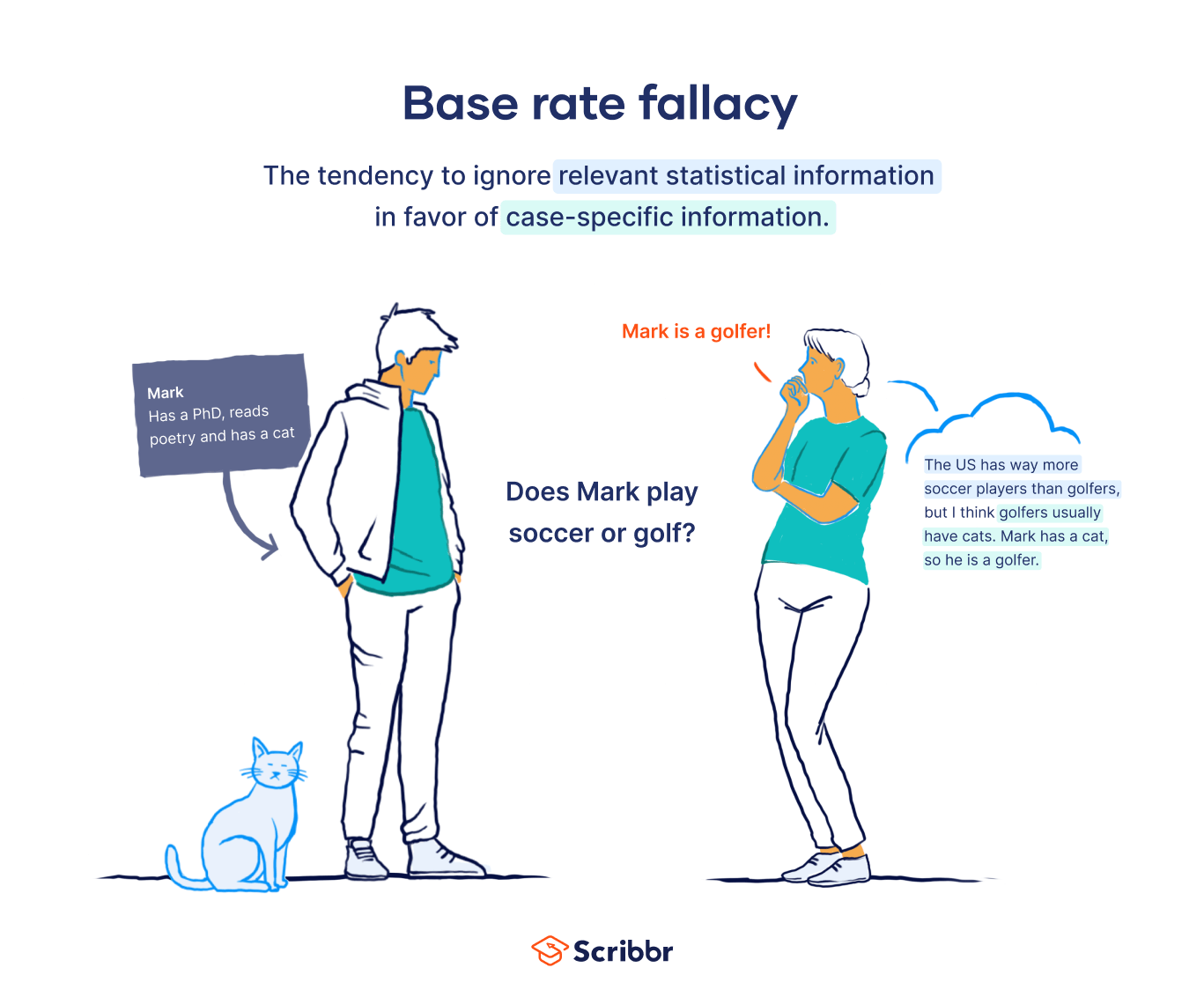

Base rate fallacy refers to the tendency to ignore relevant statistical information in favor of case-specific information. Instead of taking into account the base rate or prior probability of an event, people are often distracted by less relevant information.

Due to this, people often make inaccurate probability judgments in medical, business, and everyday decision-making contexts. Base rate fallacy is also called base rate neglect or base rate bias.

Your gut feeling tells you that Mark sounds like an upper class person, so he must play golf. However, this is the base rate fallacy at work, since far more people play soccer than golf.

What is base rate fallacy?

Base rate fallacy is a flawed reasoning pattern that causes people to believe that statistics are not relevant to the problem or question at hand. This applies to situations where we need to estimate the likelihood of something, such as someone’s occupation or favorite sport. Most people would be misguided by the personality description and not factor in that there are in fact more soccer players than golfers.

In statistics, base rate refers to the percentage of a population that has a specific characteristic. If we take a random individual and there’s no additional information, the base rate tells us the likelihood of them demonstrating that characteristic. Suppose, for instance, that around 10% of students at a particular college are dyslexic. If you selected a random person and had no information pertaining to learning difficulties, you could safely guess that there’s a 1 in 10 chance of them being dyslexic.

Why does base rate fallacy occur?

Base rate fallacy occurs because people usually pay attention to information that is specific to a certain person or event (when available) over base rates (i.e., objective, statistical data), rather than integrate the two. Two main explanations are given for that.

We form judgments by selecting the most relevant information

We form judgments by selecting the information we think is most relevant. The more specific the information we have, the more relevant we consider it. This is why base rate neglect usually coexists with recency bias. On the other hand, statistical data often seem too general or abstract (or at least that’s what our brains trick us to believe). Therefore, we see them as less relevant and fail to consider the influence of base rates.

We are misguided by the representativeness heuristic

When we estimate the probability of an event, we try to recall examples of similar events. The more similar an event is to the prototypical example of that event (in our memory), the more representative we think it is. For example, doctors use the representativeness heuristic in making diagnoses by judging how similar patients are to the prototypical patient with that disorder. In other words, we often interpret similarity as a sign of increased probability.

Why does base rate fallacy matter?

Base rate fallacy shows that people experience difficulties integrating two sources of information (one situation-specific and one more general). However, people do rely on base-rate information when it is the only information available.

Because of this, base rate fallacy can lead to inaccurate decisions in different aspects of our lives. In our interpersonal relationships, it can cause us to ignore information about how others have behaved in similar situations in the past (i.e., the base rate) and judge others on the basis of observable characteristics. These simplistic explanations of others’ behavior can lead to stereotypes.

When making medical diagnoses, healthcare professionals sometimes focus too much on individual test results and neglect the base rate information (i.e., the proportion of people who have the disease in a population). In other words, they may confuse the accuracy of a test with the probability of having a disease.

In the context of COVID-19 vaccines, the base-rate fallacy caused people to misinterpret statistics regarding vaccine effectiveness.

The key to interpreting this information correctly lies in the vaccination base rate (i.e., the percentage of the population that is vaccinated). If a large proportion of the population is vaccinated, and only a small fraction is unvaccinated, we can expect a larger ratio of vaccinated to unvaccinated individuals in the hospital.

Suppose for example, that a population is 99% vaccinated and 51% of infected individuals have been vaccinated. The base rate fallacy would cause most people to think that the vaccine has no preventive effect. However, if the vaccine was ineffective, we would expect about 99% of infected individuals to have been vaccinated.

Base rate fallacy created the misconception that vaccines are ineffective because, in highly vaccinated populations, the majority of COVID-19 cases occur among vaccinated people.

Base rate fallacy example

Under the influence of base rate fallacy, people often make poor investing decisions because they pay more attention to recent events, rather than taking a long-term view.

If the investor decides to sell, they have fallen for base rate fallacy. They will be favoring current information (the quarterly earnings report), which is just a small set of data, over larger data, which is the base rate. Instead, the investor should ask “how has the company performed in the last 10 or 15 years?” It is the historical data about the company’s performance that sets the overall context we need to look at to make the right decision.

A single weak (or strong) earnings report doesn’t give us the full picture of the company’s track record. Instead, it is most likely a blip in its overall course.

Other interesting articles

If you want to know more about fallacies, research bias, or AI tools, make sure to check out some of our other articles with explanations and examples.

AI tools

Fallacies

Frequently asked questions about the base rate fallacy

- How to avoid base rate fallacy?

-

Base rate fallacy can be avoided by following these steps:

- Avoid making an important decision in haste. When we are under pressure, we are more likely to resort to cognitive shortcuts like the availability heuristic and the representativeness heuristic. Due to this, we are more likely to factor in only current and vivid information, and ignore the actual probability of something happening (i.e., base rate).

- Take a long-term view on the decision or question at hand. Look for relevant statistical data, which can reveal long-term trends and give you the full picture.

- Talk to experts like professionals. They are more aware of probabilities related to specific decisions.

- What is an example of base rate fallacy?

-

Suppose there is a population consisting of 90% psychologists and 10% engineers. Given that you know someone enjoyed physics at school, you may conclude that they are an engineer rather than a psychologist, even though you know that this person comes from a population consisting of far more psychologists than engineers.

When we ignore the rate of occurrence of some trait in a population (the base-rate information) we commit base rate fallacy.

- What is cost-benefit fallacy?

-

Cost-benefit fallacy is a common error that occurs when allocating sources in project management. It is the fallacy of assuming that cost-benefit estimates are more or less accurate, when in fact they are highly inaccurate and biased. This means that cost-benefit analyses can be useful, but only after the cost-benefit fallacy has been acknowledged and corrected for. Cost-benefit fallacy is a type of base rate fallacy.

Sources in this article

We strongly encourage students to use sources in their work. You can cite our article (APA Style) or take a deep dive into the articles below.

This Scribbr articleNikolopoulou, K. (2023, September 04). What Is Base Rate Fallacy? | Definition & Examples. Scribbr. Retrieved April 15, 2024, from https://www.scribbr.com/fallacies/base-rate-fallacy/

Flyvbjerg, B., & Bester, D. (2021). The Cost-Benefit Fallacy: Why Cost-Benefit Analysis Is Broken and How to Fix It. Journal of Benefit-cost Analysis, 12(3), 395-419. https://doi.org/10.1017/bca.2021.9